Do you publish more than one podcast?

Earlier this month, we dug into Charles Schwab’s audio funnel to understand how and why they produce several different podcast series, each designed to reach a different audience.

But here’s the question: does it work?

It’s one thing to create multiple shows, each with its own target audience. But it’s another thing entirely to actually reach those distinct target audiences.

I wanted to understand whether Schwab’s multi-show strategy was effective, so I reached out to our partners at Simplecast to help me dig into the data.

Audience overlap analysis

Because three of Schwab’s podcasts are hosted on Simplecast, we can analyze the intersection (or overlap) between the shows’ audiences. So, for the month of October 2019, we looked at the unique listeners for:

- Choiceology with Katy Milkman

- Financial Decoder

- WashingtonWise Investor

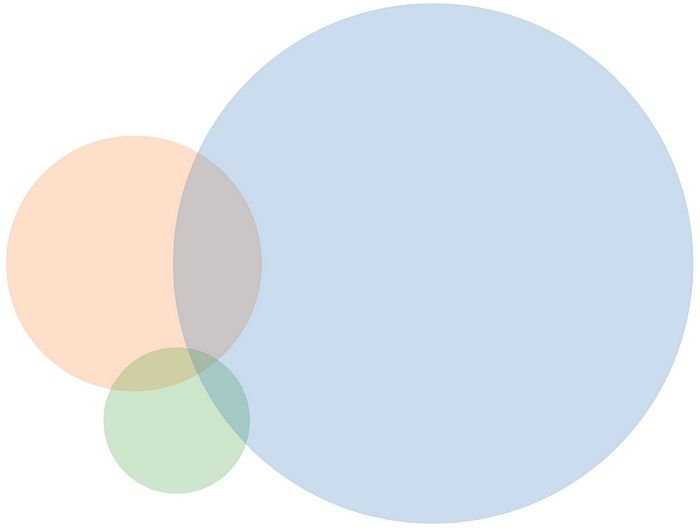

Once we analyzed the unique listener data, I could generate a Venn diagram to visualize audience overlap:

A few things stood out to me.

Choiceology had the largest audience overall. This makes sense, given that it sits at the top of the audio funnel, and takes a broadly-appealing storytelling approach. The lower-funnel shows Financial Decoder and WashingtonWise Investor had smaller audiences.

Between Choiceology and Financial Decoder, we saw an audience overlap of 5.45%. I suspect this has a lot to do with in-network promotion. As Schwab’s Patrick Ricci explains:

In recent seasons of Choiceology, each episode includes a CTA (audio and web) that mentions Financial Decoder, usually tied to the content of the Choiceology episode. So if a Choiceology episode explores a particular cognitive or emotional bias in a realm like, say, sports, the Financial Decoder mention hints at how that bias might affect your financial decision-making and your portfolio.

We saw a smaller audience overlap between Choiceology and WashingtonWise Investor (1.05%). This makes sense given that the two shows haven’t actively cross-promoted one another to date.

We also found that a small percentage of listeners (0.50%) downloaded at least one episode of all three shows in the month of October 2019. Schwab superfans (or employees, or both), I suspect.

The funnel works

Perhaps the most striking thing to me about this audience overlap analysis is that it suggests Schwab’s podcast strategy (more than one show for more than one audience) works.

Each show seems to have its own distinct audience.

Shows that cross-promote each other show higher overlap than shows that don’t.

And as Schwab’s roster of podcasts grows, they can release new shows without cannibalizing their existing audiences.

If you publish more than one podcast, how do you measure your overall audience across shows? How do you understand overlapping audiences?

Sign up for the Pacific Content Newsletter: audio strategy, analysis, and insight in your inbox. Once a week.